UAE Unemployment Insurance Scheme. The UAE government has introduced the Involuntary Loss of Employment (ILOE) insurance scheme to provide financial support to public and private sector employees who lose their jobs.

This mandatory insurance scheme acts as a safety net, offering cash benefits to employees who have subscribed to it for at least 12 consecutive months.

However, the scheme does not cover individuals who leave the country or secure a new job after losing their current employment.

Read Also: How to Get a KHDA School Transfer Certificate for Your Child in Dubai

Eligibility Criteria for ILOE

To qualify for the ILOE benefits, employees must meet specific criteria:

- Subscription Duration: Employees must have been subscribed to the scheme for a minimum of 12 consecutive months, with no subscription gaps exceeding three months.

- Premium Payments: All insurance premiums must be paid on time.

- Termination Proof: The reason for job loss must not be resignation. The termination must be confirmed through a letter from the employer and the Ministry of Human Resources and Emiratisation (MOHRE) work permit cancellation application.

- Disciplinary Reasons: Employees terminated for disciplinary reasons, as outlined in the relevant UAE labor laws, are not eligible for compensation.

- Claim Submission: Claims must be submitted within 30 days of job termination or the resolution of a labor dispute.

- Absconding Complaints: The insured employee should not have an ongoing complaint related to being absent from work (absconding).

- Fraudulent Claims: No compensation will be granted if there is evidence of fraud or deceit, or if the employer is found to be fictitious.

- Force Majeure and Other Exceptions: Compensation is not provided for job losses due to war, pollution, terrorism, government actions, or other force majeure events.

ILOE Exempted Categories

- Investors (owners of companies they work at)

- Domestic helpers

- Temporary-contract workers

- Juveniles under the age of 18

- Retirees who are entitled to a pension and joined a new job

ILOE Claim Submission Process

To claim ILOE benefits, employees must ensure their labor contract is officially canceled by their employer. The necessary steps include:

1- Filling Out the Claim Form: Submit the claim form within 30 days of termination.

2- Required Documents: Include the following in PDF format:

- Dismissal document with termination reason

- Final judicial ruling, if applicable

- Emirates ID copy

- Insurance certificate copy

- Work permit cancellation document

- Visa cancellation document

- Employment contract copy

- IBAN certificate

- Valid UAE mobile number

3- The insurer, Dubai Insurance Company, processes the claim and pays within two weeks if all documents meet the eligibility criteria. The payment is made to the insured’s designated bank account.

ILOE Processing Timeline and Notification

Once the claim is filed, the insurer verifies the documents. If approved, the insurance company transfers the compensation to the insured’s account within two weeks. It’s important to generate a travel report before visa cancellation, as it confirms the employee’s presence in the UAE.

Filing the ILOE Application

To apply for compensation, visit the ILOE website, enter your Emirates ID details and UAE phone number, and follow the steps to complete the submission.

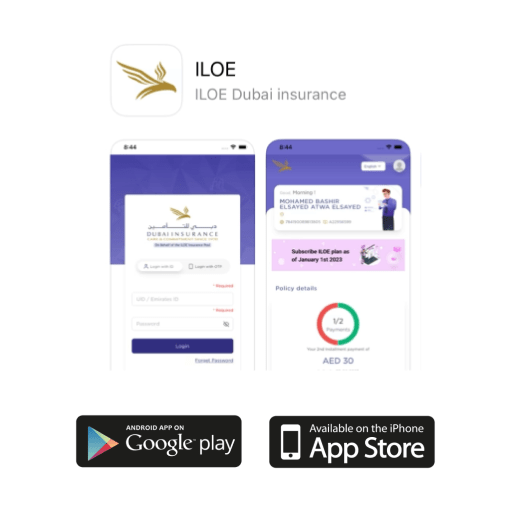

ILOE Subscription Channels

You can subscribe free of charge. There are different channels available for ILOE.

1- ILOE Portal

2- ILOE Mobile App

Other channels subject to additional service charges upon subscription

1- Exchange centers (Al Ansari Exchange)

2- Business centers Tawjeeh and Tasheel

3- Etisalat by e&

4- upay & MBME Pay

5- C3 Pay and Botim

Benefits of ILOE

The ILOE scheme offers two categories of coverage:

ILOE Category 1:

For employees with a basic salary of AED 16,000 or less. The insurance premium is AED 5 per month, with a maximum monthly compensation of AED 10,000.

ILOE Category 2:

For employees with a basic salary exceeding AED 16,000. The insurance premium is AED 10 per month, with a maximum monthly compensation of AED 20,000.

Compensation is provided for up to three months from the date of unemployment, provided the employee was not terminated for disciplinary reasons and did not resign.

Read Also: Dubai Virtual Working Programme Visa For Remote Workers

FAQs

Who is eligible for ILOE insurance?

Employees in the UAE who have subscribed to the ILOE scheme for at least 12 consecutive months, have paid all premiums on time, and were not terminated for disciplinary reasons are eligible. They must also be legally present in the UAE and not have resigned from their position.

How do I check my ILOE insurance status?

You can check your ILOE insurance status through the ILOE website or app by entering your Emirates ID details.

How to get an ILOE certificate online?

Visit the ILOE website or app, log in with your Emirates ID, and download the insurance certificate from your profile.

How to pay ILOE online?

Payments can be made online through the ILOE portal or app, using credit/debit cards or other accepted payment methods.

How do I claim the unemployment benefit?

Submit a claim form on the ILOE website or app, along with required documents, within 30 days of job termination. The insurer will process the claim and disburse payment if approved.

Who can claim unemployment insurance?

Employees who meet the ILOE eligibility criteria, including being subscribed for at least 12 months, not having resigned, and not being terminated for disciplinary reasons, can claim unemployment insurance.

How much is ILOE fine?

The fine for not subscribing to the ILOE scheme or failing to pay the premiums on time is typically AED 400 per year.

How to register in ILOE?

Register online through the ILOE website or app by providing your Emirates ID and necessary personal details.

Is there a grace period for ILOE renewal?

Yes, there is a grace period of 90 days for renewing ILOE insurance after the subscription expires.

Conclusion

The ILOE UAE insurance unemployment scheme is a crucial support system for employees in the UAE, ensuring financial stability during times of involuntary job loss. Stay informed and ensure you meet all the requirements to take full advantage of this safety net.